Annual report and accounts

Do you need help with your annual report and accounts?

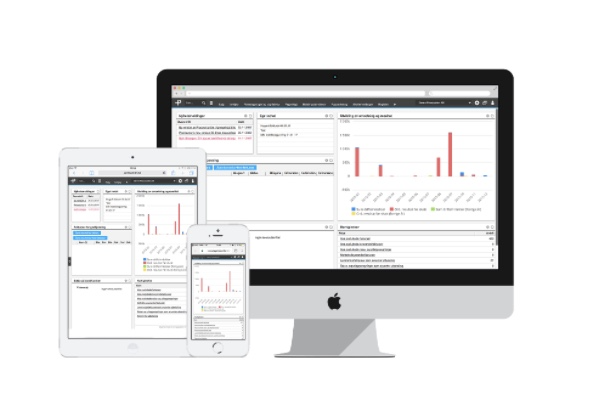

Do you own or manage a private company? If that case, you’re required to prepare official accounts and notes for the company in addition to the annual report. This is what an annual report and accounts entail. Such accounts form the basis for your tax returns (previously “selvangivelse” in Norway), income statement forms and tax documents.

Get in touch with us if you need help with your annual reports and accounts

Do you find this unclear, or do you spend a lot of time on this? There are better and easier ways! Accountor has specialists in all relevant professions and industries who are ready to help you, so you can focus on what you do best. When we say annual report and accounts, we usually mean the official financial statements of a company. This is mandatory for all private and limited companies and must be submitted to the Brønnøysund Register Centre.

Tax return and income declaration

In addition to the annual report and accounts, we can help you with tax returns, income declaration for self-employment and other tax documents. These will determine the tax of your business. If you have a sole proprietor business, your personal tax is what is calculated.

Annual Report

Together with the official accounts, a private company is required to prepare an annual report. The annual report and the company's balance sheet must be signed by the board. To present a proper annual report for your business, you need to have accurate accounting.

We have specialised professionals in several disciplines and industries who are up-to-date on changing guidelines and legislation.